6z IntzComputer InformationThe latest Canalys data, reported on May 4, shows that Global PC (including tablets) shipments decline by only 3% per year to 118.1 million units in Q1 2022. Despite this decline, shipments remained very strong compared to the pre-pandemic period, with a three-year CAGR of 12% from Q1 2019.While business demand was healthy, the slowdown in the consumer and education sectors took its toll on Chromebooks and tablets, both of which saw further declines in shipments. Tablet volume declined 3% year-over-year to 38.6 million units, while Chromebooks fell to 4.9 million units, down 60% from their record Q1 2021 performance.

Global tablet shipments declined slightly by 3%, but compared to an unusually strong first quarter in 2021. Apple shipments were down 2% in the first quarter, with 14.9 million units shipped worldwide. Second-ranked Samsung also posted a 2% decline in tablet shipments of 7.9 million units. Amazon overtook Lenovo in third place with a 3% growth rate after more than a year of heavily discounted Fire tablets. Lenovo fell second among the top five vendors, with shipments down 20% year-over-year to 3 million units. Huawei rounded out the top five with a 22% decline and 1.7 million tablets shipped worldwide.

| Global tablet shipments (market share and annual growth rate)Canalys PC Market Data: Q1 2022 | |||||

| Supplier (company) | First quarter of 2022quantity of goods shipped | First quarter of 2022market share | First quarter of 2021quantity of goods shipped | First quarter of 2021market share | annual growth rate |

| pomegranate | 14,881 | 38.6% | 15,185 | 38.2% | -2.0% |

| the belt of Orion | 7,860 | 20.4% | 7,995 | 20.1% | -1.7% |

| Amazonian | 3,568 | 9.2% | 3,453 | 8.7% | 3.3% |

| associate (cognitively) | 3,004 | 7.8% | 3,757 | 9.5% | -20.0% |

| Huawei (brand) | 1,679 | 4.4% | 2,143 | 5.4% | -21.7% |

| (sth. or sb) else | 7,604 | 19.7% | 7,183 | 18.1% | 5.9% |

| full | 38,595 | 100% | 39,716 | 100% | -2.8% |

| Note: Unit shipments are in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (Sales Shipments), May 2022 |

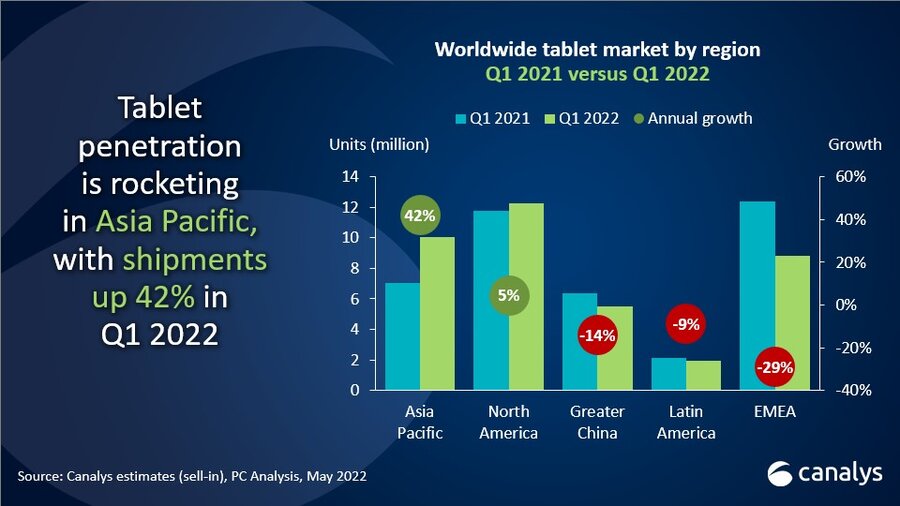

"Despite the decline in shipments in Q1, the tablet recovery remains strong," said Canalys analyst Himani Mukka. "The market has now shipped more tablets for eight consecutive quarters than it did in the fourth quarter of 2019 before the pandemic. Increasing commercial deployments are now helping to offset weakening consumer demand after a large increase in the installed base of tablets over the past two years. Looking ahead, the market will face increased supply pressure from the Russia-Ukraine conflict and China's COVID-related embargo. Lingering tablet demand from Q4 2021 is expected to carry over into Q1 2022, but the supply situation may now push backlogs of orders into the second quarter. From a regional perspective, Asia Pacific will be the growth engine for tablets as they cater to price-sensitive users in markets where broadband connectivity is a luxury. For example, certain educational deployments in India are bundling tablets with free cellular data packages to ensure that students are equipped to handle the new digital learning process. In such markets, tablets are also able to support basic productivity needs at affordable prices and better channel accessibility."

Chromebook shipments declined 60% year-over-year to 4.9 million units in the first quarter of 2021, following significant device purchases by educational institutions in key markets in the first half of the year. North America, which accounted for 72% of global Chromebook shipments, was down 64%. Chromebook volumes began to decline in the second half of 2021 after the U.S. and Japan ended their respective education buying periods. Since then, they have experienced a period of inventory buildup as the channel waits for the next Chromebook refresh cycle.

Lenovo is still at the top of the global Chromebook market, despite a 63% drop in shipments following the completion of its GIGA program in Japan, which came almost exclusively from Lenovo. Acer jumped to second place in the global market with 1.1 million units shipped, a drop of 211 TP3 T. Dell had the smallest drop of all the vendors, in part because of its limited presence in the education sector, which provides most of the shipments for other vendors. HP saw the largest drop in shipments at 82%. HP has been focused on the U.S. education market for several quarters, but has suffered greatly from market saturation. ASUS rounded out the top five, with shipments down 48%.

| Global ChromebooksShipments (market share and annual growth rate)Canalys PC Market Pulse: Q1 2022 | |||||

| Supplier (company) | First quarter of 2022quantity of goods shipped | First quarter of 2022market share | First quarter of 2021quantity of goods shipped | First quarter of 2021market share | annual growth rate_ |

| associate (cognitively) | 1,221 | 24.9% | 3,235 | 26.6% | -62.3% |

| Acer, Taiwanese PC company | 1,129 | 23.1% | 1,428 | 11.7% | -20.9% |

| Dell | 876 | 17.9% | 1,005 | 8.3% | -12.8% |

| Hewlett-Packard | 775 | 15.8% | 4,364 | 35.9% | -82.2% |

| Asus (computer manufacturer) | 460 | 9.4% | 879 | 7.2% | -47.7% |

| (sth. or sb) else | 437 | 8.9% | 1,245 | 10.2% | -64.9% |

| utter | 4,898 | 100.0% | 12,156 | 100.0% | -59.7% |

| Note: Unit shipments are in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (Sales Shipments), May 2022 |

"The global Chromebook market has experienced an expected slowdown," said Brian Lynch, research analyst at Canalys. "Saturation in the education markets in Japan and the U.S. and a slowdown in consumer spending following a spike in COVID-19 demand led to the inevitable decline in shipments. Nonetheless, in terms of broader historical performance, Chromebooks still had an impressive first quarter, and growth is bound to resume as developed markets go through refresh cycles in the coming years. Additionally, developing education markets are beginning to solidify their plans around digitization, which will give Chromebooks even more momentum. Chromebook shipments in Latin America will increase as local and state governments, particularly in Brazil, rapidly adopt the platform for educational purposes. Meanwhile, Indonesia has begun a Chromebook local manufacturing program aimed at producing large quantities for domestic educational use and export. chromebooks have struggled to expand beyond education in a significant way, but remain a viable option in enterprise environments as an affordable and manageable choice. chrome is the biggest pandemic in the entire pc ecosystem, and it's not just a pandemic that can't be solved. ecosystem as one of the biggest winners of this pandemic, and that success will continue into the future as the market continues to mature."

In the overall PC market (including desktops, laptops and tablets), Apple shipped 22.3 million units in Q1 2022, growing at a CAGR of 1%, ahead of Lenovo. Second-ranked Lenovo was down 12% year-over-year, shipping 21.1 million units worldwide. HP, which shipped 15.9 million units in third place, also experienced a significant decline of 18%. Both HP and Lenovo faced difficult comparisons from a volume standpoint due to larger Chromebook volumes in the first quarter of 2021. Dell came in fourth and benefited from a surge in business demand that helped it achieve a healthy 6.1% growth in shipments to 13.8 million units. Samsung rounded out the top five with 8.8 million units shipped.

| Global PC (including tablets) shipments (market share and annual growth rate)Canalys PC Market Pulse: Q1 2022 | |||||

| Supplier (company) | First quarter of 2022 quantity of goods shipped | First quarter of 2022 market share | First quarter of 2021 quantity of goods shipped | First quarter of 2021 market share | annual growth rate _ |

| pomegranate | 22,303 | 18.8% | 22,058 | 18.1% | 1.1% |

| associate (cognitively) | 21,088 | 17.8% | 24,020 | 19.7% | -12.2% |

| Hewlett-Packard | 15,866 | 13.4% | 19,252 | 15.8% | -17.6% |

| Dell | 13,808 | 11.7% | 13,012 | 10.7% | 6.1% |

| the belt of Orion | 8,766 | 7.4% | 9,740 | 8.0% | -10.0% |

| (sth. or sb) else | 36,738 | 31.0% | 34,020 | 27.9% | 8.0% |

| utter | 118,571 | 100% | 122,102 | 100% | -2.9% |

| Note: Unit shipments are in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (Sales Shipments), May 2022 |