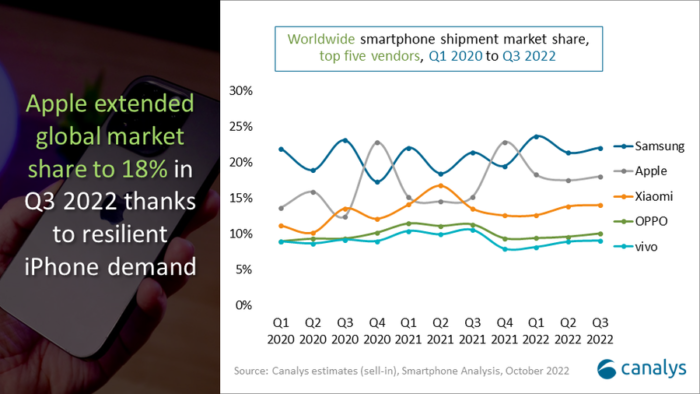

In Q3 2022, the global smartphone market recorded its third consecutive decline so far this year, down 9% year-on-year, the worst Q3 since 2014, with a bleak economic outlook causing consumers to delay purchases of electronic hardware and prioritize other essential expenditures. This is likely to continue to dampen the smartphone market for the next six to nine months. Samsung maintained its lead with 22% market share through heavy promotions to reduce channel inventory. Apple was the only supplier in the top five to record positive growth, further improving its market position with 18% share during the market downturn due to relatively strong demand for the iPhone. Xiaomi, OPPO and Vivo, on the other hand, continued to be cautious about overseas expansion amid uncertainty in the domestic market, retaining global market shares of 14%, 10% and 9%, respectively.

| Global smartphone shipment share ranking | ||

|---|---|---|

| branding | 2021Q3 Market Share | 2022Q3 Market Share |

| the belt of Orion | 21% | 22% |

| pomegranate | 15% | 18% |

| millet | 14% | 14% |

| OPPO | 11% | 10% |

| vivo | 11% | 9% |

| (sth. or sb) else | 28% | 27% |

| Source: canalys; One Plus included in OPPO shipments, rounded up, total or not 100% |

"The smartphone market has been very responsive to consumer demand, and suppliers are adapting quickly to the harsh business environment," said Canalys analyst Amber Liu. "For most suppliers, the priority is to mitigate the risk of increased inventory in the face of deteriorating demand. Suppliers had large inventories in July, but sales volumes gradually improved from September onwards thanks to aggressive discounting and promotional campaigns. The pricing strategy for the new products was carefully designed, even for Apple, to avoid strong resistance from consumers who are now very sensitive to any price increases," Liu added.

"With demand showing no signs of improvement in the fourth quarter and first half of 2023, vendors will have to work with the supply chain to make prudent forecasts for production while working closely with the channel to stabilize market share," said Sanyam Chaurasia, analyst at Canalys. "Heading into the peak selling season, consumers who have been putting off purchases will expect significant discounts and bundle promotions, as well as significant price reductions on older generation devices. Holiday sales are expected to be slow and steady in the fourth quarter of 2022 compared to last year's strong demand period. However, it is too early to view the upcoming fourth quarter as a true turning point in the market's recovery.