6z IntzCell Phone InformationMay 16, 2011 - According to Counterpoint Research, themilletIt crossed the 500 million smartphone base mark earlier this quarter, joining Apple and Samsung Theoretically, Xiaomi's large user base could (1) help the company's brand grow further if the products meet or exceed expectations, (2) give Xiaomi more opportunities to monetize traffic on its smartphones, and (3) allow the company to efficiently cross-sell other IoT products, such as TWS and smartwatches.

Xiaomi has taken its brand recognition to a new level, going global from its main value-for-money phone channel, but it hasn't monetized traffic or cross-sold IoT devices as effectively in many regions as it has in China.

Better brand recognition

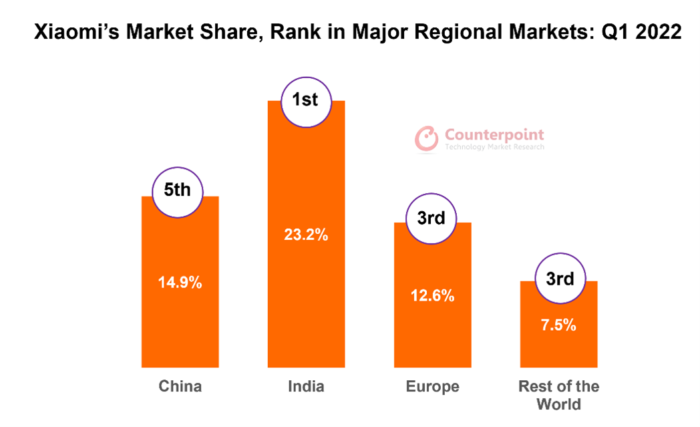

Xiaomi has been the dominant force out of China seeking more growth potential as its domestic market matures. 2021 was a bumper year for it as the COVID-19 pandemic and government helicopter money-spreading spurred consumers to buy smartphones. Xiaomi's successful global expansion was particularly evident in India and Europe, where it ranked among the top three OEMs in the first quarter of 2022.

Traffic Realization

Does Xiaomi's 500 million install base offer more opportunities for smartphone monetization?

Xiaomi categorizes its smartphone traffic revenues as "Internet services", reaching RMB 28.2 billion ($4.16 billion) in 2021. Xiaomi disclosed that in December 2021 its outstanding monthly active MIUI users reached 508.9 million. While both metrics have been growing as the company expands overseas, average revenue per user (ARPU), a measure of monetization efficiency, has continued to decline over several quarters. To be fair, Xiaomi's overseas smartphone shipments haven't helped it significantly increase its internet service revenue.

Xiaomi's ARPU in China is much higher than in other regional markets, and ARPU for high-end smartphones is higher than for low-end smartphones. This partly explains the strategic importance of China's high-end smartphone segment, even though demand seems weak at the moment. Additional profits and revenues from Chinese high-end smartphone users could further help Xiaomi subsidize its overseas sales channels, enter new countries and strengthen its global marketing campaigns.

According to Xiaomi, more than 80% of its Internet service revenue comes from China, with advertising being a major contributor. In regional markets outside of China, it's impossible to foresee when or if Xiaomi will be able to challenge Google and its Google Mobile service, or when it won't have to share advertising revenue with the U.S. company. The company should consider other ways to monetize its installed user base. It could try fintech, e-commerce and other services that could utilize its MIUI in conjunction with other consumer IoT products.

Cross-selling IoT products

Xiaomi has an IoT ecosystem that encompasses a variety of products, from TWS to TVs to vacuum robots. But we have yet to see Xiaomi fully utilize it. In India, for example, Xiaomi is the largest OEM in the Indian market in 2021, with a shipment share of 24.1%. but its smartwatch and TWS shipments failed to even crack the top five (according to Counterpoint's TWS and smartwatch trackers), and that's in a market where smartwatch shipments grew by 2,74% year-on-year in 2021 and TWS shipments grew by 60% year-on-year in the same period. in a market that is growing 60% YoY. Xiaomi missed the boat, but it's not too late as the regional competitive landscape is not yet fully mature.

In India, a value-for-money strategy is key to winning the consumer IoT market. Especially when it comes to smartwatches, until last year Xiaomi's portfolio was a bit pricey (~$117-130), but the Redmi Watch 2 Lite helped the brand achieve strong growth of 238% in Q1 2022. This approach should be sustained.

Xiaomi should also consider increasing SKUs in the Indian market, where the product refresh rate is high compared to China. Xiaomi's current product portfolio can't match that of its competitors such as Noise which launches five products in a quarter.

reach a verdict

Xiaomi has successfully entered most regional markets around the world and has upgraded its brand image from a market disruptor offering cheap phones to an established OEM expanding in the premium segment.

However, Xiaomi will need to take innovative approaches to cash in on traffic to its overseas products. Measures such as fintech, e-commerce and "buy now, pay later" are gaining traction globally. Launching more premium smartphones in China will also help. But it won't happen overnight, and will require sustained investment in everything from R&D to consumer research to branding.

Finally, Xiaomi should not pass up the opportunity to cross-sell more IoT devices in fast-growing markets like India. A more balanced product portfolio with quality entry-level products is key to competing with the local kingpins.